A major challenge in everyday business transactions is that the purchase price of the same product is not always the same. It keeps changing. Sometimes the product is purchased at a lower price, and sometimes at a higher price. The selling price, stock value, profit, and loss of a business largely depend on this varying purchase cost of products.In such a situation, a common question arises—at which price should calculations for selling price, stock value, or profit and loss be made? One of the most widely used solutions in this case is the Average Cost Method.

In this method, an average price or average cost is determined for each product, which changes according to new purchases or sales returns of that product. As a result, business owners can easily know the actual cost, profit and loss, and stock value. Small and medium-sized businesses in Bangladesh can now use the popular accounting software HishabPati to perform these calculations very easily.

This blog contains-

What is Average Cost Method ?

The Average Cost Method is an inventory and accounting management technique in which different purchase prices of the same product are averaged to determine a specific price or cost.For example, suppose you initially bought 10 units of a product at 100 Taka each, and a few days later, you bought the same quantity of the same product at 120 Taka each. Now, the average cost of your total 20 units would be—

- (1000 + 1200) ÷ 20 = 110 Taka

In other words, the average purchase cost of each product is 110 Taka. Now, if you sell 5 units out of the 20, the calculation for this sale will be based on the average cost of 110 Taka per unit.

Let's understand with another example

Suppose you purchased Paracetamol tablets three times or added them to stock using the stock adjustment feature in the HishabPati app.

- The first time, you bought 100 tablets at 5 Taka each = 500 Taka.

- The second time, you bought 200 tablets at 6 Taka each = 1200 Taka.

- The third time, you bought 100 tablets at 4 Taka each = 400 Taka.

Here, the total purchase = 400 tablets and the total cost = 2100 Taka. So, the average price or purchase cost will be—

- 500 + 1200 + 400) ÷ 400

- 2100 ÷ 400 = 5.25 Taka per tablet

Now, whenever you sell each Paracetamol tablet, all calculations will be based on the price of 5.25 Taka per tablet.

How will profit and loss be calculated using this method?

Two things are important when calculating profit and loss in a business—

- Cost of Goods Sold (COGS)

- Selling Price

When using the Average Cost Method, COGS (Cost of Goods Sold) is always calculated based on the average purchase cost. This means that whenever a product is sold, the average cost per unit is considered as the cost for each unit.

Continuing from the above example, let’s calculate the profit and loss—

Suppose you sold 50 units at 7 Taka per unit. If the average cost per unit is 5.25 Taka and you sell it at 7 Taka, then the profit per unit will be—

- Selling Price − Average Purchase Cost = Profit

- 7 − 5.25 = 1.75 Taka profit per unit

The complete calculation will be as follows—

- The total purchase cost or COGS for 50 units = 50 × 5.25 = 262.5 Taka

- Sales revenue for 50 units = 50 × 7 = 350 Taka

- Total Sales Revenue − Total Average Purchase Cost = Total Profit

- 350 − 262.5 = 87.5 Taka total profit

Using this method, a business can easily understand its profit and loss. The calculations are not complicated, and the average purchase cost is updated every time new stock is added. No matter how many times you sell, profit will always be calculated based on this average cost.

How is stock value calculated using the Average Cost Method?

Stock value is the total cost of the remaining products in a business. When using the Average Cost Method, the calculation is—

- Current Stock × Average Purchase Cost = Stock Value

Opening Stock Value -

- Total stock = 400 units

- Average purchase cost = 5.25 Taka

- 400 × 5.25 = 2100 Taka

After selling 50 units, Stock Value -

- Remaining stock = (400 − 50) = 350 units

- Average purchase cost = still 5.25 Taka

- 350 × 5.25 = 1837.5 Taka

In other words, the average cost does not change after a sale, but the stock value decreases. In this way, with every new transaction, the stock value is updated, and business owners can always see the current stock value.

When will the average purchase cost of a product change?

According to the Average Cost Method, the average cost of a product does not always remain the same. It changes in the following situations—

1. When new purchases are made

Whenever you purchase products at a new price, the average cost will be updated. For example, if you buy an additional 100 units at 8 Taka each = 800 Taka, then—

- Old stock = 350 units and stock value = 1837.5 Taka

- New stock = 100 units and cost = 800 Taka

- Total stock = (350 + 100) = 450 units

- Total purchase cost or expense = (1837.5 + 800) = 2637.5 Taka

- New average purchase cost or price = 2637.5 ÷ 450 = 5.86 Taka per unit

2. When a purchase is returned

If some purchased products are returned, the stock will decrease, which will reduce the total cost/purchase value, and the average cost will be recalculated accordingly. The new average purchase cost is determined based on the remaining stock and its total cost.

3. When a sales return occurs

If a customer returns a product, it is added back to stock at the average purchase cost at the time of sale.

- If the average purchase cost has changed due to new purchases or purchase returns, then when the returned product is added back to stock, the average cost will be recalculated accordingly.

- And if the average purchase cost remains the same, there will be no change, because the returned product is added at the same previous average cost.

4. When a purchase is edited or deleted

This is very important. We usually edit or correct purchases to fix mistakes. When a purchase is edited, the corrected information is considered as true for all times. When a purchase is deleted, it is assumed that these products never existed. Therefore, the average purchase cost is recalculated excluding the edited or deleted entries.

If this adjustment is made after a sale, it will also affect that sale. This is because the profit or loss of that sale was originally calculated using the incorrect average purchase cost. Those calculations must also be corrected.

Suppose you initially recorded the purchase of 200 units at 6 Taka each, but later corrected it to 7 Taka each. This means the total cost of 200 units changed from 1200 Taka to 1400 Taka. Then—

- Previous Calculation: Total cost for 400 units = 2100 Taka, average cost = 5.25 Taka

- After Edit: Total cost = 2300 Taka, average cost = 5.75 Taka

This change affects not only future calculations but also the profit and loss of previous sales.

Example:

Sale of 50 units at 7 Taka each

- Previous Calculation = 262.5 Taka → Profit = 87.5 Taka

- Cost Afterwards = 287.5 Taka → Profit = 62.5 Taka

In other words, the related reports will also change. The profits of previous sales will be recalculated using the new average purchase cost and automatically updated.

5. When a sale is edited or deleted

If you change the quantity or price of a sale, the average cost does not change. However, the profit and stock value will be updated according to the new calculation.

How will the Average Cost Method work offline?

Many of our users are temporarily offline, so they need to use the app without internet. Therefore, the Average Cost Method will still work in the HishabPati app even when used offline.

- All the transactions you perform offline will be calculated and stored locally on your device.

- Once your device is back online, all the data will automatically sync with the server.

- As a result, reports will always remain updated, preventing any confusion.

How is it possible to make accounting changes on offline?

When using the app offline, there may sometimes be discrepancies in the accounts. For example—- Suppose a salesperson is making sales offline.

- Meanwhile, you recorded some new purchases online (or processed purchase returns/edits/deletions).

- This causes the average purchase cost on the server to change.

- However, the offline salesperson’s device will not receive the new information until they go online.

So, they will make sales based on the previous average purchase cost, while your online calculations will use the updated average cost.

What happens after syncing online?

Later, when that employee’s device goes online from offline, their data will sync. At this time, it will first check whether there has been any change in the average purchase cost.

- If there is no change, the data recorded offline will be saved on the server exactly as it was shown offline.

- And if there is a change, those transactions will be automatically updated according to the new average purchase cost.

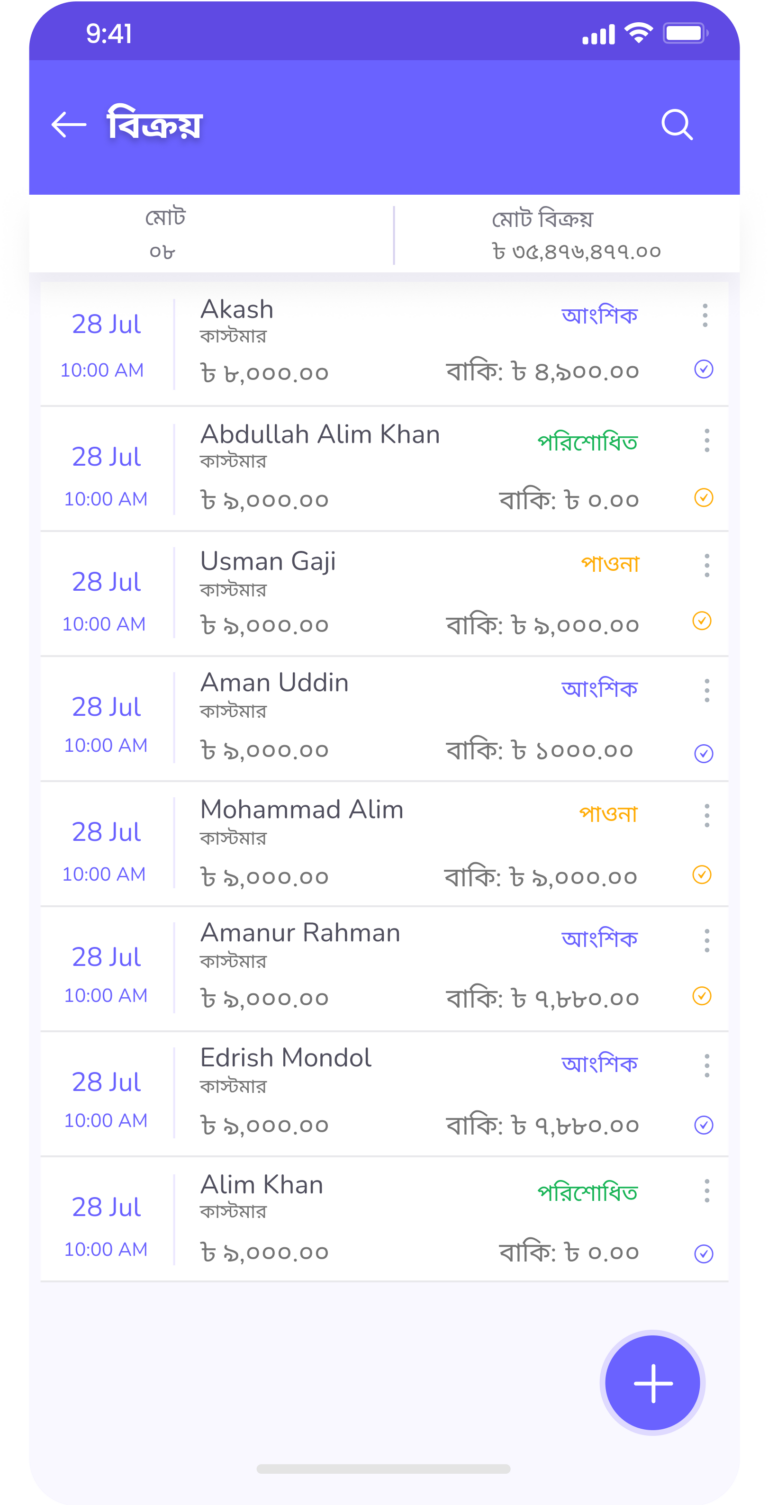

Special provisions in HishabPati for accounting transparency

HishabPati is always committed to maintaining business transparency. For this purpose, two types of icons are used on the right side of each sale in the sales list page—

- One is the purple check mark (✓) icon: This icon means that the transaction, whether done online or offline, has been saved on the server exactly as it was recorded. There is no complication.

- The other one is the yellow exclamation (!) icon: This icon means that the transaction, as recorded offline, could not be synced exactly the same way when going online. Some details are incomplete, and the system will notify you to complete them.

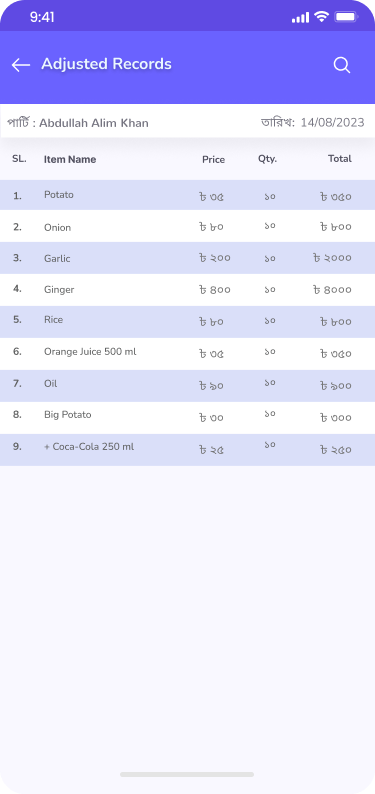

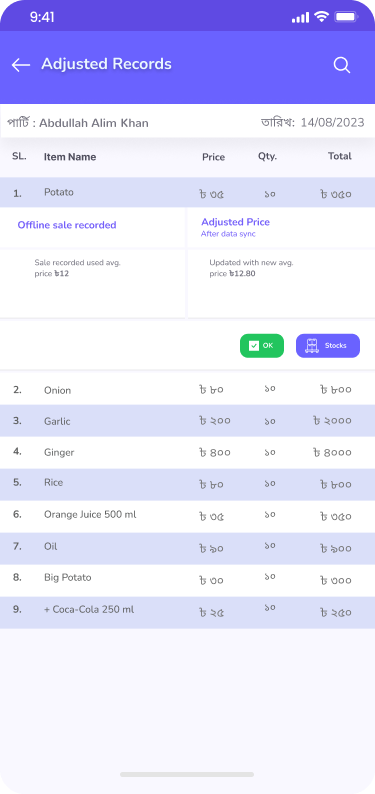

To see what changes were made or what is incomplete, tap/click on the transaction. You will be taken to the “Adjusted Record” page. A single transaction may include many products. The products whose average purchase cost has changed and required adjustment will be shown here.

Tapping on a specific product in the list will show the details.

On the Adjusted Record page, tapping/clicking on a specific product will show what adjustments were made and why.

For example, as shown in the image below, when this product was sold offline, its average purchase cost was 12 Taka. However, before going online, a new purchase changed the average cost to 12.80 Taka. Therefore, the profit for this sale has been recalculated based on the new average cost of 12.80 Taka and saved on the server.

Now, the function of the user action button

Here you will find two buttons. That means, in the case of adjusted calculations, you will have two options—

- OK – Tapping/clicking the OK button will turn the yellow exclamation (!) icon on the sales list page into a check mark (✓). This means you have accepted the adjusted calculation.

- Stocks – By tapping this button, you can go to the Stock Adjustment or Purchase Products page to add new products. However, this button is needed only in special situations!

Solution for Edge Case

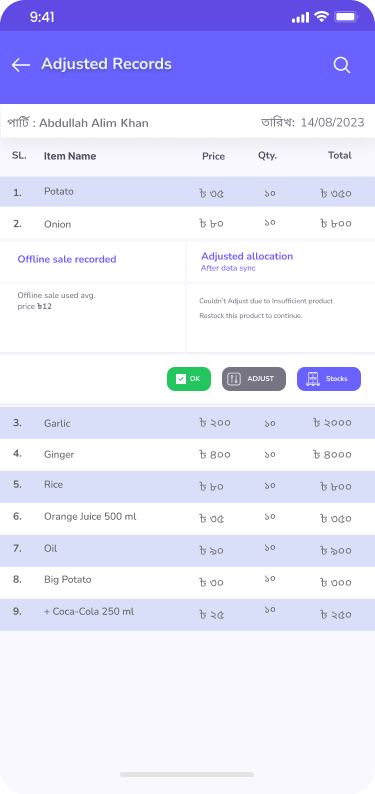

In rare cases, it may happen that after making sales offline, when going online, the required stock is no longer available or insufficient. This is because someone else has already sold the stock online, and no new products have been added. In this situation, during sync, the system will not find the products sold offline in the stock. However, there is no need to worry—the system will notify you about it. See the example in the image below—

In such a situation, clicking the stock button will show you the available quantity of that product in stock. From here, you can add new stock either through HishabPati’s Stock Adjustment or Purchase page to update the product in stock.

After adding the product to the stock, the Adjust button will be activated. Tapping this button will complete the transaction at the new average purchase price. Then, if there are products in stock with different average purchase prices, you will see them as usual. When you tap the OK button, the yellow mark will change into a check mark.

Use the Average Cost Method in HishabPati

The Average Cost Method is one of the most reliable ways to maintain business accounts. Using the HishabPati app, business owners can seamlessly apply this method both online and offline. If any changes occur when offline transactions are synced online, users can clearly see them. Ensure updated reports and accurate profit and loss calculations with HishabPati!

Demo - View this & start your journey with HishabPati in three simple steps!

- Step 1: Sign up on HishabPati

First, go to the HishabPati website and create an account for your business. Or, to make managing your business easier, download and install the ‘HishabPati’ app for free today.

Then complete the registration. The registration process in HishabPati is very easy and completely free!

- Step 2: Set up your company

After signing up, first set up your business profile by providing the necessary information as the owner. Then, set up essential business aspects such as inventory, units, purchases and sales, outstanding balances, invoices, and transactions. After that, start updating daily transactions.

- Step 3: Enjoy the various features of HishabPati

Once you start managing your business accounts with HishabPati, make sure to utilize the necessary and unique features, such as invoicing, barcode scanning, units, and expense management. To understand how to use HishabPati and its features in detail, watch demo videos in Bengali on YouTube.

Digital ledger for income and expenses – HishabPati demo.

HishabPati is a simple and affordable accounting app. Its subscription fees are divided into different durations and offered in budget-friendly packages. Learn more about the pricing and features today in details & choose your desired package. Good luck with your business!